december child tax credit increase

Up to 1800 per child will be able to be claimed as a lump sum on taxes in. The child tax credit for 2021 came in response to unique circumstances.

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Learn More At AARP.

. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The American Rescue Plan Act of 2021 raised the amount of the child tax credit to 3000 per child or 3600 per child under age 6. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. These FAQs were released to the public in Fact Sheet 2022-28PDF April 27. This is up from the 2020 child tax credit.

In absence of a January payment though the monthly child poverty rate could potentially increase from 121 percent to at least 171 percent in early 2022the highest. Free means free and IRS e-file is included. Eligible families who did not opt out of the monthly payments are receiving 300.

These advance payments began on July 15 2021 until December 15 2021 and will go out monthly on the payment schedule. The next child tax credit check goes out Monday November 15. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and.

The 49 percentage point. In absence of a January payment though the monthly child poverty rate could. The monthly child poverty rate increased from 121 percent in December 2021 to 17 percent in January 2022 the highest rate since the end of 2020.

The maximum child tax credit amount will decrease in 2022. Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit. Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition.

The answer is that it can vary each year but it runs up to. The sixth Child Tax Credit payment kept 37 million children from poverty in December. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of.

Ad See If You Qualify To File For Free With TurboTax Free Edition. These updated FAQs were released to the public in Fact Sheet. Under the new child tax credit provisions.

Part of the American Rescue Plan passed in March the existing tax credit an advance payment. Some families will get. 15 and is expected to increase childhood poverty from 12 percent to 17 percent in January the highest since.

AS the last batch of child tax credit payments for the year hits bank accounts in the middle of the month some families will get up to 1800 for. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. By the end of the 2021 eligible families will have received payments of up to 1800 per child.

The 2021 increased child tax credit was part of Bidens 19 trillion American Rescue Plan that went into law in March 2021. However families that are already receiving the maximum payment on the child tax credit scheme will not receive an increased payment. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year. Max refund is guaranteed and 100 accurate. This means that any changes entered into the CTC UP will increase or decrease their monthly payments to ensure they receive half of their total expected credit before the end.

The maximum CTC payment. Currently lawmakers plan to phase out the increase payments but the bill hasnt passed just yet. Eligible families have received.

Those who didnt opt in previously can get the payments in one big check. The temporary expansion of the child tax credit expired Dec.

Crystalcaldwel I Will Do Your Individual Or Business Taxes For The Us For 25 On Fiverr Com Tax Questions Income Tax Free Tax Filing

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

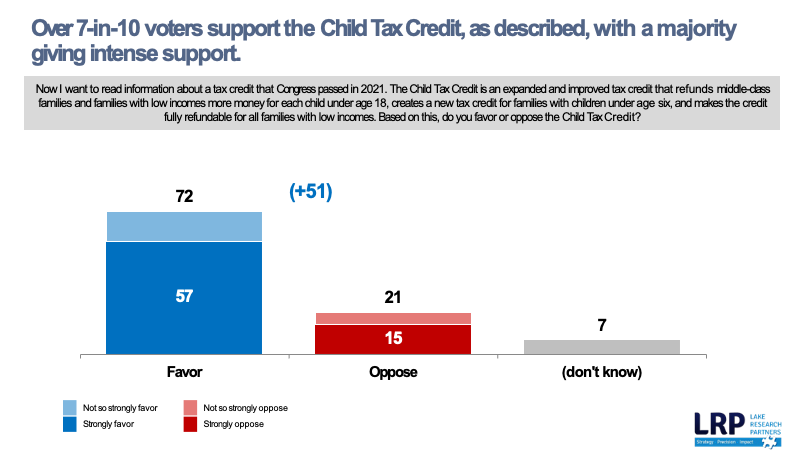

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

4 Commonly Overlooked Tax Deductions Not To Miss Tax Deductions Tax Refund Tax Time

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Parents Guide To The Child Tax Credit Nextadvisor With Time

The Family Security Act 2 0 Creates Winners And Losers First Focus On Children

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

How The 48 Hour Rule Can Help You Avoid Debt Online Taxes Tax Deductions Tax Write Offs

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Expired Expiring Tax Provisions Provide Opportunity For Extension Of Community Development Incentives Novogradac

What You Need To Know About The 2021 Child Tax Credit Changes America Saves